What Home Buyers And Sellers Need To Know

The federal and provincial government made some changes to buying and selling real estate and mortgages. Bellow we discuss:

- Property Transfer Tax and the First Time Buyers Exemption

- Down Payment Changes for homes over $500,000

- Stress Test for Conventional and Unconventional Mortgages and High Ratio Premiums

- Home Owners Grant threshold

Property Transfer Tax

First Time Home Buyers Program

You may have to pay a Property Transfer Tax. The cost is 1% on the first $200,000, 2% on the amount over $200,000 - $2,000,000, 3% greater than $2,000,000 and 5% for properties $3,000,000 and higher. Foreign Buyers must pay an additional 20% P.T.T.

The First Time Home Buyers Program can save first-time buyers up to $10,000 when purchasing a home valued up to $500,000. (There is a proportional exemption for homes priced between $500,000 - $525,000) Or, first-time buyers can access the Newly Built Homes Exemption, which can save buyers up to $13,000 in property transfer tax when purchasing a newly constructed or subdivided home worth up to $750,000.

To qualify for a full exemption, at the time the property is registered you must:

- Be a Canadian citizen or permanent resident

- Lived in B.C. for 12 consecutive months immediately before the date you register the property or filed at least 2 income tax returns as a B.C. resident in the last 6 years

- Have never owned and interest in a principal residence anywhere in the world at any time

- Have never received a first time home buyers exemption or refund

- The property must be located in B.C.

- The property must be used as your principal residence

- The property must have a fair market value of $500,000 or less

- You may qualify for a partial exemption up to a fair market value of $525,000

Down Payment Changes

As of February 2016 the minimum down payment for new insured mortgages increased from 5% to 10% for the portion of the house above $500,000. You are still allowed a down payment of 5% for homes valued up to $500,000.

Example: If you purchase a home for $500,000, the minimum down payment will be $25,0000 (5% x $500,000=$25,000). If you purchase a home for $600,000, the minimum down payment will be $35,000 ((5% x $500,000=$25,000) + (10% x $100,000=$10,000) = $35,000)

Homes purchases over $1,000,000 require a down payment of at least 20% of the purchase.

* A high ratio mortgage is a mortgage where the borrower has a down payment of less than 20% sometimes known as a non-conventional mortgage. A Low ratio mortgage is a mortgage where the borrower has a down payment that is 20% or more of the purchase price, sometimes known as a conventional mortgage.

Regulatory changes announced by the Office of Superintendent of Financial Institutions (OSFI)

Mortgage terms you need to know:

Insured Mortgage / High Ratio Mortgage: Mortgage insurance is mandatory with less than 20% down payment.

Uninsured Mortgage / Conventional Mortgage: 20% or greater down payment/equity

Contract Rate: the interest rate offered by the lender to the consumer

Benchmark Rate / Qualifying Rate = Stress Test: Five-year benchmark rate published by the bank of Canada (currently as of 1/1/2018 4.89%) OR CONTRACT RATE+2%, whichever is greater.

LTV (Loan To Value) = the size of the mortgage compared to the value of the property securing the loan

Starting January 1, 2018 Rules for Uninsured Mortgages

Uninsured mortgage consumers must now qulaify using a new minimum qualifying rate. The rate will be the greater of the five-year benchmark rate published by the Bank Of Canada OR the lender contractual mortgage rate +2%.

The biggest impact will be on the amount for which the home buyer/owner will be able to qualify. Previously, the home buyer/owner qualified at the contract rate offered by the lender. While the actual mortgage payment will still be paid at the contract rate, a higher calculation will be used for qualification purposes.

for a printable pdf click here

for more information click here

Effective November, 2016 the federal government enacted the “Stress Test”. All insurers must “stress test” their ability to carry their mortgage payments at whichever is greater: the negotiated rate in their mortgage contract or the Bank of Canada’s five-year fixed posted rate. Contract rates remain low so the Canada posted rate currently at 4.64% (March 29,2017) is what you will be qualified on.

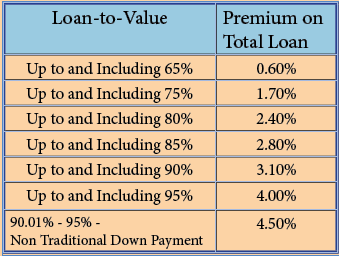

You must pay an insurance premium to obtain an insured mortgage. The CMHC Mortgage Loan Insurance premium is calculated as a percentage of the loan and is based on the size of your down payment. The higher the percentage of the total house price/value that you borrow, the higher percentage you will pay in insurance premiums.

* Down Payment Requirements — Traditional sources of down payment include: Applicant’s savings, RRSP withdrawal, funds borrowed against proven assets, sweat equity (<50% of min. required equity), land unencumbered, proceeds from sale of another property, non-repayable gift from immediate relative, equity grant (non-repayable grant from federal, provincial or municipal agency). Non-traditional sources of down payment include: Any source that is arm’s length to and not tied to the purchase or sale of the property, such as borrowed funds, gifts and 100% sweat equity.

New Changes For Home Owners

Canada Revenue:

When you sell your principal residence or when you are considered to have sold it, you usually do not have to report the sale on your income tax and benefit return and you do not have to pay tax on any gain from the sale. This is the case if you are eligible for the full income tax exemption (principal residence exemption) because the property was your principal residence for every year you owned it. Starting with the 2016 tax year, generally due by late April 2017, you will be required to report basic information (date of acquisition, proceeds of disposition and description of the property) on your income tax and benefit return when you sell your principal residence to claim the full principal residence exemption.

Home Owners Grant:

The B.C. government announced an increase to the threshold for the Home Owners’ Grant from $1,200,000 in 2016 to $1,600,000 for 2017 to $1,650,000 in 2018. Homeowners who are below this new threshold will have a discount of up to $570 on their annual property taxes for their primary residence. There are additional grants available to clients living in rural areas, those with disabilities, and/or those who are over 65 years of age. (also see the 30 cost saving programs available in my “Cost Saving Programs” insert in the back of this binder.

R.R.S.P.

Registered Retirement Savings Plan

Qualified buyers can use up to $25,000 of their R.R.S.P. to buy a home. Couples can use up to $50,000.

The home must be the principal residence, the home buyer must nor have owned a home within the past 5 years and the loan must be repaid within 15 years. Home buyers who have already used the plan and have fully repaid their R.R.S.P. may be eligible to use the plan a second time.